The shocking truth of the pending EU collapse!

Problem, reaction, solution.

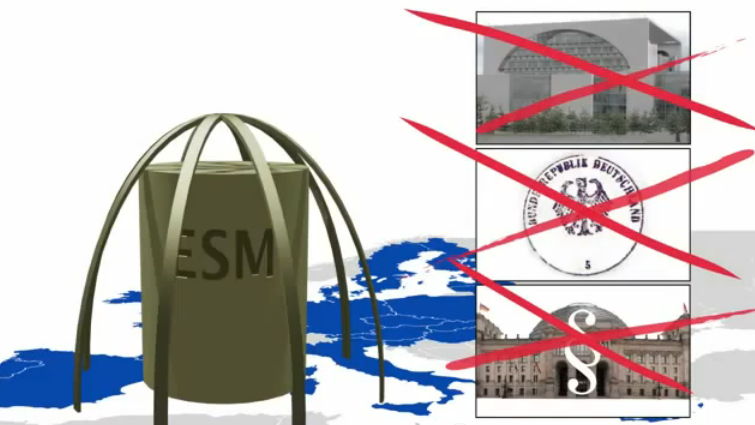

In search for end of economic crisis the EU leaders reached an agreement and signed a Treaty establishing European stability mechanism (ESM). Critics say the ESM resembles an enabling act, because it severely confines the economic sovereignty of its member states without parliamentary influence or control.

From Article 9 – ESM Members hereby irrevocably and unconditionally undertake to pay on demand any capital call made on them by the Managing Director pursuant to this paragraph, such demand to be paid within seven days of receipt.

Also articles 27 and 30 define extensive immunity rules like the following: The property, funding and assets of the ESM shall, wherever located and by whomsoever held, be immune from search, requisition, confiscation, expropriation or any other form of seizure, taking or foreclosure by executive, judicial, administrative or legislative action.

So even judicial control is removed.

In July 2013, the ESM will assume the tasks currently fulfilled by the European Financial Stability Facility (EFSF) and the European Financial Stabilisation Mechanism (EFSM).

THE CONTRACTING PARTIES – the Kingdom of Belgium, the Federal Republic of Germany, the Republic of Estonia, Ireland, the Hellenic Republic, the Kingdom of Spain, the French Republic, the Italian Republic, the Republic of Cyprus, the Grand Duchy of Luxembourg, Malta, the Kingdom of the Netherlands, the Republic of Austria, the Portuguese Republic, the Republic of Slovenia, the Slovak Republic and the Republic of Finland (the “euro area Member States” or “ESM Members”); COMMITTED TO ensuring the financial stability of the euro area; RECALLING the Conclusions of the European Council adopted on 25 March 2011 on the establishment of a European stability mechanism (ESM) HAVE AGREED AS FOLLOWS:

The treaty was signed on July 11 2011, by finance ministers of the 17 euro-area countries. The Treaty follows the European Council decision of 25 March 2011 and builds on an amendment of Article 136 of the Treaty on the Functioning of the European Union (TFEU).

In July 2013, the ESM will assume the tasks currently fulfilled by the European Financial Stability Facility (EFSF) and the European Financial Stabilisation Mechanism (EFSM).

Excerpts from the Treaty mentioned in video

ARTICLE 8

Authorised capital stock

1. The authorised capital stock shall be EUR 700 000 million. It shall be divided into seven

million shares, having a nominal value of EUR 100 000 each, which shall be available for

subscription according to the initial contribution key provided for in Article 11 and calculated in

Annex I.

2. The authorised capital stock shall be divided into paid-in shares and callable shares. The

initial total aggregate nominal value of paid-in shares shall be EUR 80 000 million. Shares of

authorised capital stock initially subscribed shall be issued at par. Other shares shall be issued at

par, unless the Board of Governors decides to issue them in special circumstances on other terms.

3. Shares of authorised capital stock shall not be encumbered or pledged in any manner

whatsoever and they shall not be transferable, with the exception of transfers for the purposes of

implementing adjustments of the contribution key provided for in Article 11 to the extent necessary

to ensure that the distribution of shares corresponds to the adjusted key. T/ESM/en 20

4. ESM Members hereby irrevocably and unconditionally undertake to provide their

contribution to the authorised capital stock, in accordance with their contribution key in Annex I.

They shall meet all capital calls on a timely basis in accordance with the terms set out in this Treaty.

5. The liability of each ESM Member shall be limited, in all circumstances, to its portion of the

authorised capital stock at its issue price. No ESM Member shall be liable, by reason of its

membership, for obligations of the ESM. The obligations of ESM Members to contribute to the

authorised capital stock in accordance with this Treaty are not affected if any such ESM Member

becomes eligible for, or is receiving, financial assistance from ESM.

***

ARTICLE 9

Capital calls

1. The Board of Governors may call in authorised unpaid capital at any time and set an

appropriate period of time for its payment by the ESM Members.

2. The Board of Directors may call in authorised unpaid capital by simple majority decision to

restore the level of paid-in capital if the amount of the latter is reduced by the absorption of losses

below the level established in Article 8(2), as may be amended by the Board of Governors

following the procedure provided for in Article 10, and set an appropriate period of time for its

payment by the ESM Members. T/ESM/en 21

3. The Managing Director shall call authorised unpaid capital in a timely manner if needed to

avoid the ESM being in default of any scheduled or other payment obligation due to ESM creditors.

The Managing Director shall inform the Board of Directors and the Board of Governors of any such

call. When a potential shortfall in ESM funds is detected, the Managing Director shall make such

capital call(s) as soon as possible with a view to ensuring that the ESM shall have sufficient funds

to meet payments due to creditors in full on their due date. ESM Members hereby irrevocably and

unconditionally undertake to pay on demand any capital call made on them by the

Managing Director pursuant to this paragraph, such demand to be paid within seven days of receipt.

***

ARTICLE 10

Changes in authorised capital stock

1. The Board of Governors shall review regularly and at least every five years the maximum

lending volume and the adequacy of the authorised capital stock of the ESM. It may decide to

change the authorised capital stock and amend Article 8 and Annex II accordingly. Such decision

shall enter into force after the ESM Members have notified the Depositary of the completion of

their applicable national procedures. The new shares shall be allocated to the ESM Members

according to the contribution key provided for in Article 11 and in Annex I.

***

ARTICLE 27

Legal status, privileges and immunities

1. To enable the ESM to fulfil its purpose, the legal status and the privileges and immunities set

out in this Article shall be accorded to the ESM in the territory of each ESM Member. The ESM

shall endeavour to obtain recognition of its legal status and of its privileges and immunities in other

territories in which it performs functions or holds assets. T/ESM/en 38

2. The ESM shall have full legal personality; it shall have full legal capacity to:

(a) acquire and dispose of movable and immovable property;

(b) contract;

(c) be a party to legal proceedings; and

(d) enter into a headquarter agreement and/or protocols as necessary for ensuring that its legal

status and its privileges and immunities are recognised and enforced.

3. The ESM, its property, funding and assets, wherever located and by whomsoever held, shall

enjoy immunity from every form of judicial process except to the extent that the ESM expressly

waives its immunity for the purpose of any proceedings or by the terms of any contract, including

the documentation of the funding instruments.

4. The property, funding and assets of the ESM shall, wherever located and by whomsoever

held, be immune from search, requisition, confiscation, expropriation or any other form of seizure,

taking or foreclosure by executive, judicial, administrative or legislative action.

5. The archives of the ESM and all documents belonging to the ESM or held by it, shall

be inviolable. T/ESM/en 39

6. The premises of the ESM shall be inviolable.

7. The official communications of the ESM shall be accorded by each ESM Member and by

each state which has recognised the legal status and the privileges and immunities of the ESM, the

same treatment as it accords to the official communications of an ESM Member.

8. To the extent necessary to carry out the activities provided for in this Treaty, all property,

funding and assets of the ESM shall be free from restrictions, regulations, controls and moratoria of

any nature.

9. The ESM shall be exempted from any requirement to be authorised or licensed as a credit

institution, investment services provider or other authorised licensed or regulated entity under the

laws of each ESM Member.

***

ARTICLE 30

Immunities of persons

1. In the interest of the ESM, the Chairperson of the Board of Governors, Governors, alternate

Governors, Directors, alternate Directors, as well as the Managing Director and other staff members

shall be immune from legal proceedings with respect to acts performed by them in their official

capacity and shall enjoy inviolability in respect of their official papers and documents. T/ESM/en 41

2. The Board of Governors may waive to such extent and upon such conditions as it determines

any of the immunities conferred under this Article in respect of the Chairperson of the Board of

Governors, a Governor, an alternate Governor, a Director, an alternate Director or the

Managing Director.

3. The Managing Director may waive any such immunity in respect of any member of the staff

of the ESM other than himself or herself.

4. Each ESM Member shall promptly take the action necessary for the purposes of giving effect

to this Article in the terms of its own law and shall inform the ESM accordingly.

People really need to wake up to the total stupidity of some of the EU leaders.

Sarkozy and Merkel appear to be the worst, either completely unaware of public sentiment or just stubborn because the don`t have the courage to admit its all gone wrong. Prolonging the agony is the action of fools. We need to face up to the fact that some countries should leave for their own good, and delaying simply adds to the costs and makes the EU look even more miserably desperate than they already do. I hope the leaders responsible are held to account for this pathetic failure and response to failure.

Before anyone replies with “the EU breakup will cause huge problems”, we know this already,, but its better to take the hit now and deal with it. If we delay, not only will it cost more, but we really do risk big scale civil unrest. The people don`t want this model, and the EU refuses us the vote because they know the answer. How did we get in this mess ?